As a CIS researcher, I have been able to observe vast amounts of data and project underlying trends that could have a huge impact on the future of various industries. Since construction started back up following the pandemic earlier this year, a pattern has begun to emerge which could prove costly in the near future due to various factors – Increasing building material costs.

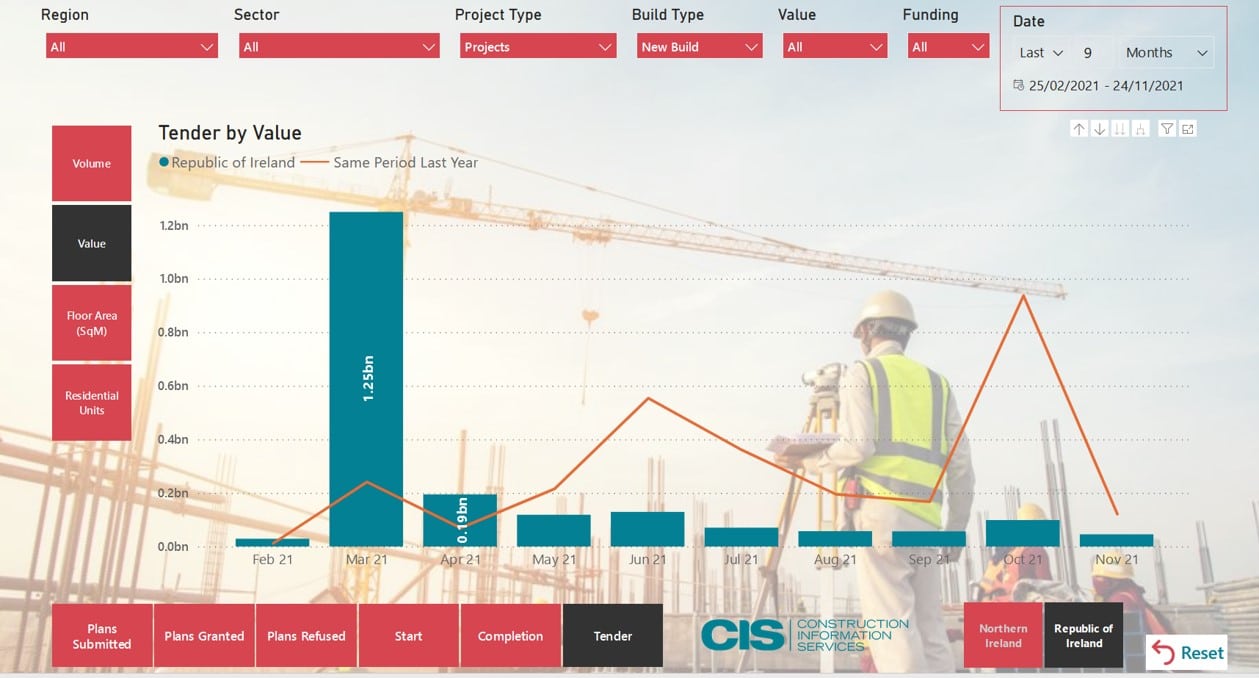

As of 15th March 2021, House rebuilding costs increased by an average of 7.3% nationally over the last 18 months. Builders facing double-figure raw material as suppliers warn customers of price increases ranging from 5-20%. This sentiment has maintained as prices have kept on increasing all of 2021. This higher cost of building materials could reasonably ‘lock out’ homebuyers from an already declining situation.

Industry group, the Irish Home Builders Association (IHBA) said in a survey that record timber prices, Covid-related stoppages, depleted inventories, delays in shipping and Brexit-related transport issues have increased the cost of building materials required for the construction of new homes. As of 25th May, Housebuilders in Ireland claim that the average cost of a new home could jump by between €12,000 and €15,000, by the end of the year due to the surge in prices for building materials. The IHBA also state there has been an estimated 4% rise in bricks prices since December 2019 and a 1% increase in 2021 alone.

By the start of Summer, Ireland’s largest construction firm Sisk began writing to key ministers from relevant Government departments regarding its concerns over material shortages that have hampered the industry. It is understood Sisk’s concerns related to public infrastructure spending and housing, with the shortages leading to dramatic price increases in some materials. The rising cost of building materials is the biggest post-Brexit worry for Irish firms, the Central Statistics Office (CSO) has found.

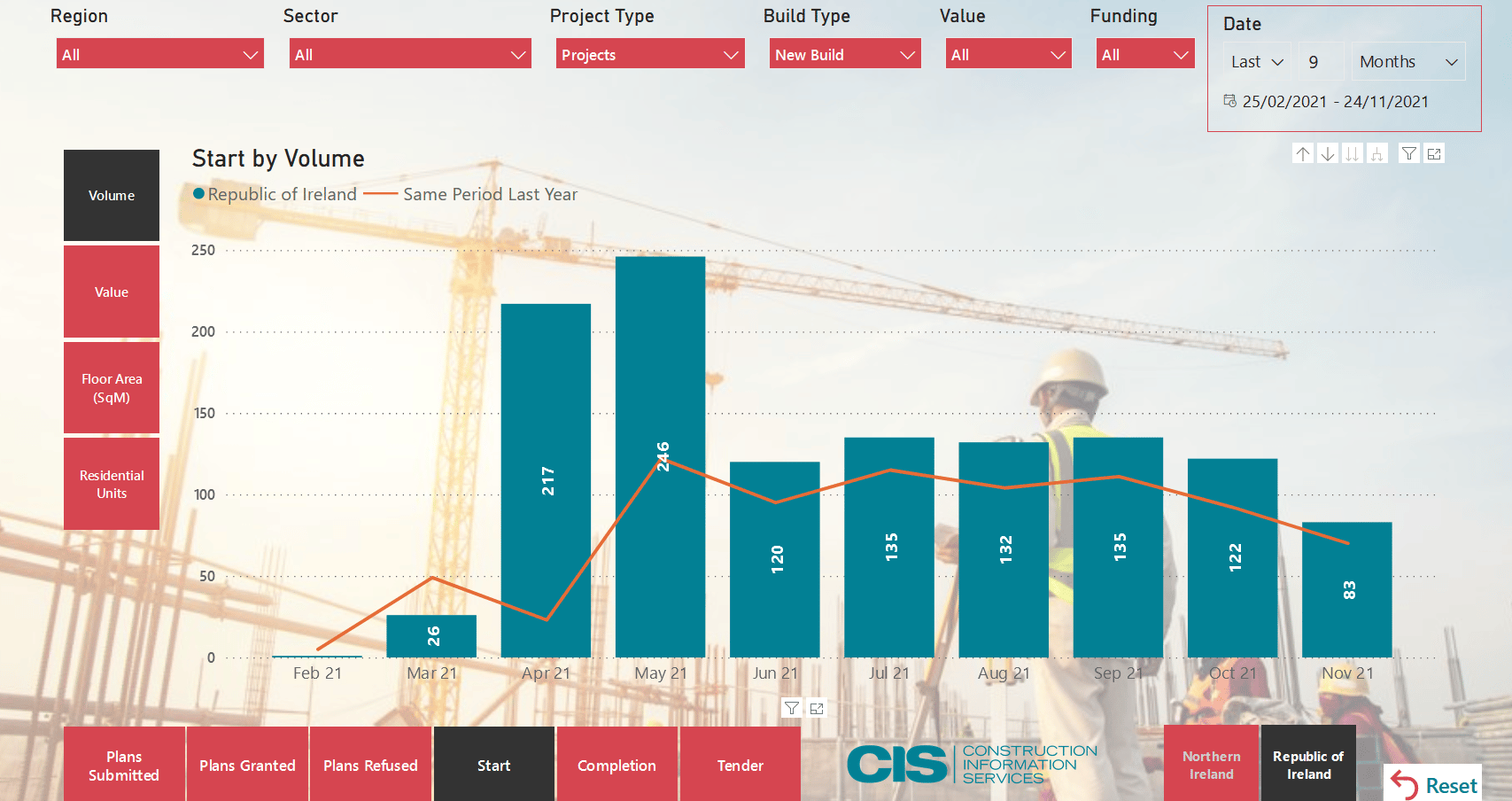

As building sites reopened in July 2021, a wave of price inflation has hit construction materials, heaping costs onto beleaguered builders struggling to make up for lost time after a year of intense disruption. Supply issues, Over the past 12 months, an unlikely series of mishaps, freak weather events and other strange occurrences have combined with the pandemic to throttle global supply chains. Before Covid-19 hit Europe, KMC were running a surplus in terms of building materials. At the time, if you remember, we were dealing with the onset of a potential ‘hard Brexit’. As such, many suppliers were stockpiling building materials for the fear that there might be major supply line issues on the way. As the Brexit saga continued and we eventually got a milder deal over the line, we were left with a significant stockpile of building material to draw down on as the pandemic swept through Ireland and beyond. During the first lockdown, this stockpile offset an increased demand on material due to home improvements and the eventual reopening of the building industry, so there was a general smoothing of the supply curve afterwards. However, the next major issue was the phase of winter lockdowns, which affected factories and saw mills particularly in Europe. They would normally have been building up a stock of material for the following Spring (i.e early 2021). Add to this the Suez Canal blockage and Britain formally leaving the EU in January and you have a perfect storm.

The Irish building industry emerged from lockdown only to find that there was a massive shortage of key building materials. The first product to be hit was building (‘rough’) timber. This is the ideal timber used in roofs, stud walls, trusses, door frames and the like. There are currently issues with both Irish and European timber supplies. There are also growing difficulties in Ireland relating to log harvesting. Next in line is insulation, much of which is manufactured in Europe. Also affected, is steel and PVC, especially PVC drainage pipes, due to a shortage of key raw materials in the manufacturing process. The cost of many of the building products above has been increasing steadily since late March, with many products going up 10-15% per month and rising. July figures compiled by the IHBA, show that timber costs have increased by almost 16% in the past 12 months, while steel has risen in price by 23%. Softwood has gone up by 31% while less obvious items like metal studs and mesh have also inflated substantially in cost.

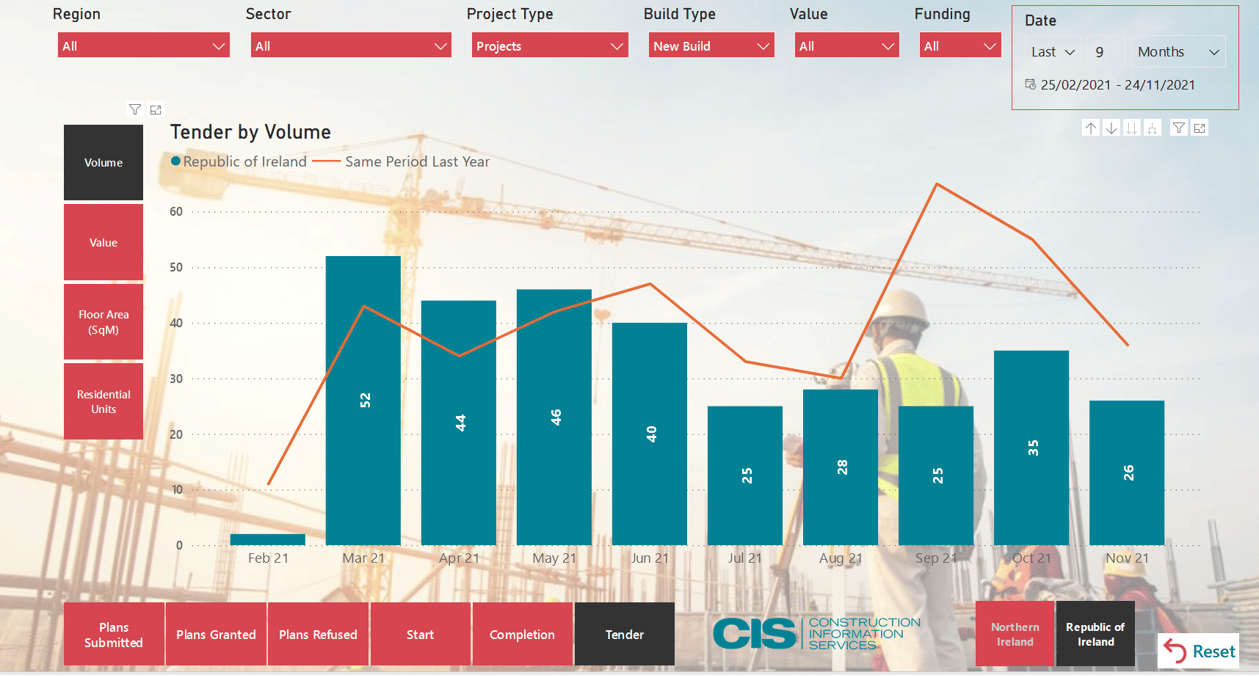

As we entered into Autumn, soaring costs in building materials begin to pose a threat to economic growth, Turner & Townsend’s report warns. Builders believe labour costs will rise 4.4% and material prices 6.8% in next 12 months. Price hikes range from 34.2% for reinforcing bars to 7.5% for copper”, according to the report. Local shortages of timber, allied with manufacturing disruptions caused by Covid-19 and extreme weather, have sent some costs soaring by up to 60% labour costs. Contractors surveyed by Turner & Townsend predicted that tender prices could rise 8.9% in 2021, 3.5% next year and 1.6% in 2023. On the 12th of September, the government began developing a system to allow spiralling building costs to be shared between construction firms and public sector bodies. By the end of September, some contractors simply couldn’t stand over the prices they gave only three months ago.

What does this mean for the future of Irish construction? We seem to be stuck in a state of limbo currently as is the rest of the global economy due to delays in the supply chain, and ever-increasing costs of materials leading, particularly in Irelands case, an increase in tender prices and re-negotiations of existing tenders. This will slow down construction across the housing sector despite promises from the government to rectify the housing shortage and we will not see a return to the level of construction in 2019 until 2023 at earliest.

Make sure not to miss the second part of my 2022-2024 forecast where I will be covering the state of Office and Warehouse construction.

From planning to completion, CIS monitors and tracks all construction activity in Ireland and Northern Ireland. Please do not hesitate to contact me at [email protected] if you have any questions about this report. By clicking here or emailing [email protected], you can also join up for a no-obligation free trial of CIS Online.

Download CIS reports by clicking the button below.

Download CIS reports by clicking the button below.